Altron FinTech Short-term Credit Impact (AFSCI) Index

About the Altron FinTech Short-term Credit Impact (AFSCI) Index

The AFSCI Index has been developed on behalf of Altron FinTech by Keith Lockwood, an independent economic consultant and adjunct faculty member of the Gordon Institute of Business Science.

We have released our latest Short-term Credit Impact Index, known as the AFSCI Index tracking the impact of short-term credit extension on the South African economy. The index is compiled independently by economist Keith Lockwood each quarter.

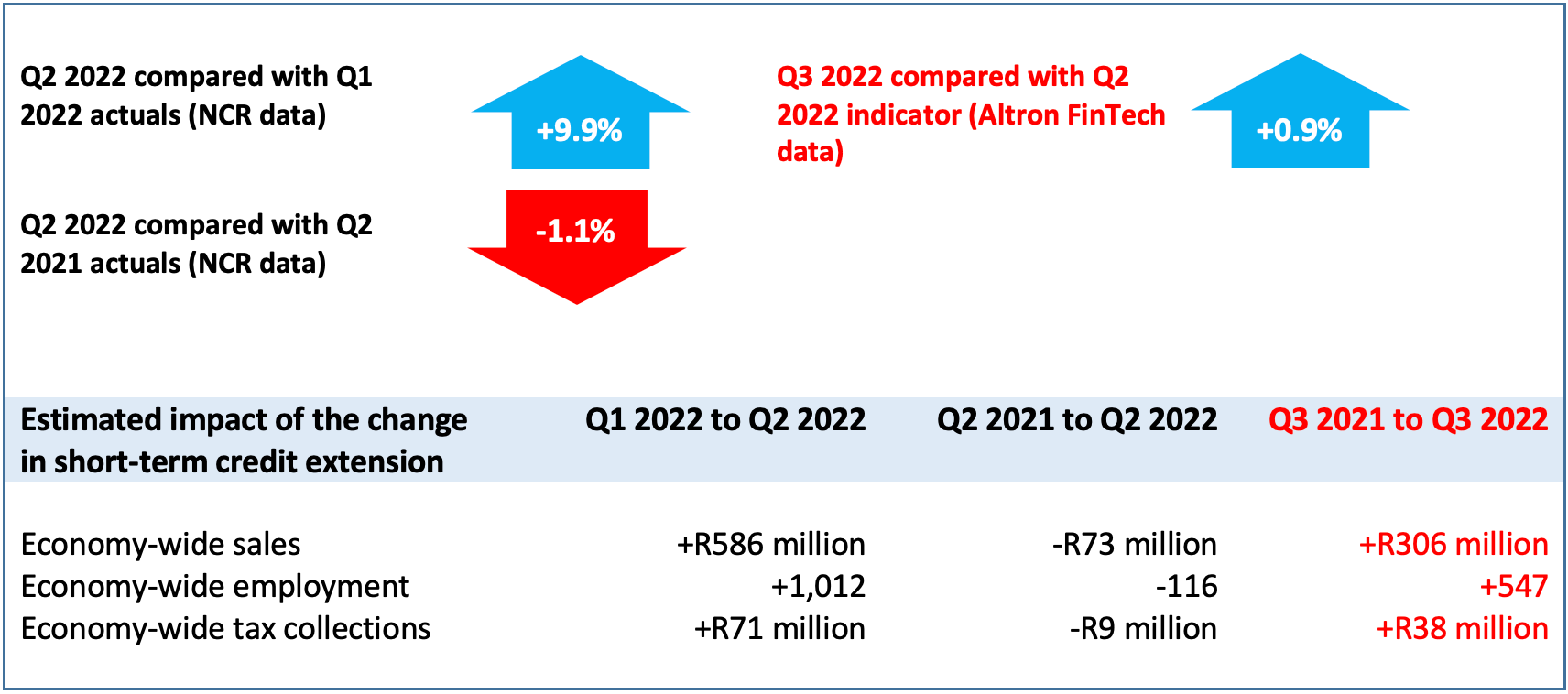

Based on National Credit Regulator (NCR) data for the second quarter of 2022, there was a significant increase of almost 10% in the AFSCI Index when compared to the first quarter of the year. However, relative to a year earlier, the index is down just over 1%.

HIGHLIGHTS OF THE LATEST INDEX

MEDIA RELEASE

Altron FinTech Short-term Credit Impact (AFSCI) Index - Quarter 2 2022

Data shows further quarter-on-quarter increase in net short-term credit extension of 0.9%

Johannesburg, 7 December 2022 - Altron FinTech has released its latest Short-term Credit Impact Index, known as the AFSCI Index, which tracks the impact of short-term credit[1] extension on the South African economy on a quarterly basis. The index is compiled independently by economist Keith Lockwood.

Based on National Credit Regulator (NCR) data for the second quarter of 2022, there was a significant increase of almost 10% in the AFSCI Index when compared to the first quarter of the year. However, relative to a year earlier, the index is down just over 1%.

To ensure more up to date information, trends in short-term credit extension are now supported by data from Altron FinTech to provide a useful indicator of likely trends in the third quarter of 2022. This data points to a further quarter-on-quarter increase in net short-term credit extension of 0.9% in Q3 2022.

Another key finding is that while short-term credit made 12% less of an impact on the economy in Q2 2022 than it did at the start of 2015 – the index’s baseline year – it is now making 111% more of an impact than it did at the height of the COVID-19 lockdowns in Q2 2020. Altron FinTech data suggests that the impact of this form of credit increased further in Q3 2022.

Lockwood explains why the index remains pertinent: “While short-term credit represents a very small share of total consumer credit, it is important because it provides a barometer of the financial health of a vulnerable, and often neglected, portion of South Africa’s population.”Highlights of the latest index[2]

Lockwood notes that given the lag in the release of credit data by the NCR it is worth remembering what was happening in the economy between March and September of this year – the focus of the new credit data covered by this release.

“The South African economy was impacted by a range of developments in the second and third quarters of 2022. Russia’s invasion of Ukraine further disrupted global supply chains – already impacted by Chinese COVID-related lockdowns – causing food and energy commodity prices to spike. This contributed to rapidly rising inflationary pressures and monetary tightening both globally and in South Africa, which caused the post-COVID recovery to lose momentum. Many countries, particularly those where household debt to disposable income levels are already at historically high levels, are experiencing a cost-of-living crisis and there are concerns that a number of advanced economies will experience recessions.”

Lockwood say that while South Africa was spared some of these impacts because of its comparatively lower household debt levels, household spending remains under pressure because of persistently high unemployment levels, rising inflation (principally for transport and food), higher debt servicing costs and extended declines in real per capita incomes. “The domestic economic has also faced additional headwinds from increased industrial action – particularly at Transnet – and from increased disruptions to electricity supply from Eskom.”

As was highlighted in the previous edition of the AFSCI Index, a large number of South African households try to survive on income levels that are below various poverty lines, with average monthly household expenditure ranging from as little as R920 per month to R7,450 per month in Expenditure Deciles 1 to 5.

“Given other expenditure priorities, the capacity of these households to take on, and service, additional debt is limited. This reality is reflected in two ways: Firstly, registered credit providers continue to reject two thirds of all credit applications; and secondly, the amount of credit that lower income households are able to access is limited. An extended expansion of the amount of credit that lower income households can access will therefore depend largely on sustained growth in real per capita incomes, which requires substantially higher rates of real GDP growth, accompanied by increased labour absorption of lower skilled workers.”

In this context, says Lockwood, it is worth emphasising that lower income households access a substantially higher proportion of short-term credit than other forms of credit simply because short-term credit is relatively more accessible to lower income groups than other forms of credit. “This is due in part to short-term lenders operating within local communities and being able to use their personal knowledge of applicants to assess the risk of default in ways that are different to the more rigid risk assessment criteria applied by commercial banks.”

“As a consequence of their ability to access short-term credit, consumers were able to purchase goods and services to the value of R1.86 billion in the second quarter of 2022. These purchases in turn generated economy-wide sales of almost R6.6 billion. “

Other key findings:

- As at the end of the second quarter of 2022, the value of credit still on the books of registered credit providers amounted to R2.19 trillion – up 6.4% on a year earlier and 1.1 % (R24 billion) higher than the previous quarter. Over 52% of this consisted of mortgages, 22% was secured credit, over 13% was credit facilities. Developmental and short-term credit only accounted for 2.6% and 0.1% respectively.

- In the year to Q2 2022, the total value on consumer credit on the books of credit providers increased by R10.5 billion. Forty-three percent of this increase was due to an increase in unsecured credit, with a further 33% from credit facilities and 19% from secured credit. Mortgages accounted for 9% of the growth but short-term credit made no discernible impact and developmental credit made a negative contribution of 3%.

- Between the start of 2015 and Q2 2022, the average value of all short-term loans increased by 48%, compared with increases in consumer prices of 36 percent and nominal/current priced GDP per capita of 40% over the same period.

Johan Gellatly, MD of Altron FinTech, says the information provided by the AFSCI Index continues to assist the industry as a whole to be aware of important trends. “At Altron FinTech, we watch these with a sharp eye to ensure our credit solutions remain geared to assist our clients to meet market demand, and to continue innovating in our space so that we remain competitive.”

He adds that Altron FinTech is able to assist customers’ businesses to trade profitably despite challenging market conditions. “Our team has a deep understanding of how best to assist customers to de-risk their businesses, trade and to grow, taking into account the market and specifically the segment conditions. This is based on the expert knowledge of the credit sector that we have built up over the years.”

[1] Short-term credit is defined as loans with values not exceeding R8,000 that are repayable within six months.

[2] The calculation of the economic impact in this edition used the latest CPI weights for different expenditure deciles. As a result, the values may vary from those of previous editions.