Altron Fintech Household Financial Resilience Index (AFHRI)

The purpose of the AFHRI index is to assess the state of micro-lending in South Africa from the perspective of the ability of borrowers to repay their loans. The data provides more clarity on the financial disposition of households and their ability to cope with debt. Please join Altron Fintech’s MD, Mr Johan Gellatly, and Dr Roelof Botha, economic advisor to the Optimum Investment Group, who developed the AFHRI on behalf of Altron Fintech for the Q4 results.

MEDIA RELEASE

Altron FinTech Household Resilience Index (AFHRI) Quarter 4 2021

Consistent improvement in ratio of household income to debt costs (20% up over past two years) and recovery of household disposable income since Q1 2021 (3.3% gain)

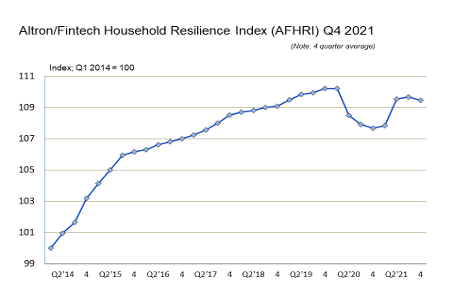

Johannesburg, 13 April 2022 – The results of the Altron FinTech Household Resilience Index (AFHRI) were released today, showing that there has been good recovery in most key economic sectors since the third quarter of 2020, the height of the COVID-19 pandemic, with the AFHRI trend line returning to growth.

Now in its third iteration, the index – commissioned by Altron FinTech to provide essential data giving more clarity on the financial health of South African households in general, and their ability to cope with debt in particular – is compiled by renowned economist Dr Roelof Botha on a quarterly basis.

Encouraging features of the latest AFHRI include a consistent improvement in the ratio of household income to debt costs (an improvement of 23.3% over the past two years) and the recovery of household disposable income since the fourth quarter of 2021 (a 2.7% gain).

Botha explains that the AFHRI trend line now broadly mimics other key economic indicators in South Africa, including GDP, retail trade sales and the IHS Markit Composite Purchasing Managers’ Index. It also echoes the results of the latest Absa Purchasing Managers’ Index (March 2022), which has shown three consecutive months of gains, suggesting a tentative return of confidence in the country.

“Although the index is still marginally lower than during the fourth quarters of 2019 and 2020, it is now 8.1% stronger than during the worst quarter of the pandemic. It also increased by 2.2% on a quarter-on-quarter basis.”

The results of the AFHRI were, however, negatively impacted by the unrest that took place in the third quarter of 2021.

In explaining the need for an index such as the AFHRI, Botha says that in South Africa reports related to household debt have typically been characterised by a lack of objectivity, particularly about the short-term lending industry. “Short-term loans and unsecured credit by micro finance institutions have played a significant role in combating a key element of global inequality, namely the ability of individuals to expedite expenditure on consumption goods, including food, and also to assist with the financing of working capital for small and micro enterprises.”

Proof of this lies in an econometric modelling exercise conducted in 2019 by Professor Ilse Botha of the University of Johannesburg. The study indicated that, between the first quarter of 2015 and the third quarter of 2018, South Africa’s GDP would have been R191-billion lower in the absence of credit provided by micro finance institutions.

Further findings of the AFHRI

The table summarises the performance of the different indicators comprising the AFHRI since the base period (2014) and year-on-year. Due to the abnormal effects of the pandemic in 2020, a comparison is also provided with the fourth quarter of 2019 (pre-COVID-19), which assists with an objective assessment of the extent of recovery from the pandemic.

|

% Change in the constituent Altron FinTech HRI indicators - fourth quarter 2021 |

|||

|

% |

% |

% |

|

|

Indicator |

Since Q1 '14 |

y-o-y |

Q4'19 - Q4'21 |

|

Official pension fund lump sum payments |

21.9 |

-3.3 |

51.0 |

|

Ratio - Household income to debt costs |

26.0 |

5.5 |

23.3 |

|

Unit trust assets |

46.9 |

8.6 |

20.0 |

|

Annuities paid |

42.8 |

-0.4 |

15.4 |

|

Civil debt defaults (reciprocal) |

52.3 |

1.9 |

11.2 |

|

Ratio - Household wealth to income |

6.3 |

4.5 |

8.9 |

|

Long-term insurance claims paid |

6.4 |

9.0 |

8.1 |

|

Employment - Public sector |

6.7 |

3.7 |

5.7 |

|

Short-term insurance premiums paid |

9.5 |

4.4 |

4.5 |

|

FNB House Price Index |

62.6 |

1.2 |

2.2 |

|

Credit extension to Households (reciprocal) |

4.5 |

0.8 |

0.7 |

|

Index |

11.1 |

-0.8 |

-1.6 |

|

Household disposable income |

21.8 |

2.7 |

-2.3 |

|

Ratio - Household income to debt |

7.4 |

1.2 |

-2.9 |

|

Household consumption expenditure |

14.5 |

1.7 |

-2.9 |

|

Salaries - Public sector |

15.4 |

-2.4 |

-4.0 |

|

Salaries - Private sector |

8.6 |

-1.3 |

-6.3 |

|

Employment - Private sector |

-6.2 |

0.0 |

-7.8 |

|

Long-term insurance surrenders |

-3.3 |

-34.2 |

-9.3 |

|

Credit impairments by banks (reciprocal) |

-39.8 |

5.8 |

-22.0 |

|

Ratio - Salaries to GDP |

-5.7 |

-7.8 |

-27.1 |

|

Note: Ranked by % change since Q2 2019 |

|||

Botha says that between the third and fourth quarters of 2021, only six of the 20 indicators recorded declines, a clear indication of further progress with recovery of the financial disposition of households.

“Unfortunately, the unrest that occurred in July 2021 took its toll on the third quarter, which prevented an improvement in the index on a year-on-year basis.”

Other findings include the following:

- Compared to the second quarter of 2019 (pre-COVID-19), eleven of the indicators have recorded improvements, five of them in double-digit territory.

- Unfortunately, three of the four indicators that possess the largest weighting in the index have not yet recovered from the effects of the pandemic. These are employment in the private sectors and salaries in both the public and private sectors.

Botha says that although the latest results of the AFHRI confirm a systematic improvement in the ability of the average household in South Africa to incur and service debt, government needs to prioritise policies aimed at employment creation, especially in the private sector, where a predictable causal relationship exists between salaries and value added in the economy.

“Due to the strong positive correlation between private sector credit extension and GDP growth, it has become a matter of urgency for government to reconsider the undue regulatory burden that has been placed on the formal micro finance sector. Unless lower income groups are allowed easier access to credit, the pace of employment creation in South Africa will remain muted.”

CEO of Altron FinTech, Johan Gellatly, says that the AFHRI has been extremely useful to the company, particularly as it provides technology platforms to registered short-term credit providers that serve this market.

“Like the Altron FinTech Short-term Credit Impact Index, the data provided by the Altron FinTech Household Resilience Index gives us vastly better knowledge of how the market our customers serve is reacting to economic pressures. This enables us to provide technology platforms supported by rich data that are fully capable of enhancing our customers’ ability to service their clients.

“In commissioning this index, we are again providing a much-needed and unbiased industry-wide benchmark for regulators, policy makers, statisticians, and our customers, helping them to understand what exactly impacts the financial resilience of South African households, and, importantly, their ability to incur and service debt. We remain hopeful that this important segment of the South African economy will be taken more seriously by government policy makers so that short-term credit providers can excel even more in their support of the informal sector.”