Altron FinTech Household Financial Resilience Index (AFHRI)

About the Altron FinTech Household Resilience Index (AFHRI)

In recognition of the need for data that provides more clarity on the financial disposition of households in general, and their ability to cope with debt in particular, Altron FinTech commissioned economist and economic advisor to the Optimum Investment Group, Dr Roelof Botha, to assist in designing this index. The AFHRI comprises 20 different indicators, weighted according to the demand side of the short-term lending industry and calculated on a quarterly basis, with the first quarter of 2014 being the base period, equalling an index value of 100.

Please join Altron Fintech’s MD, Mr Johan Gellatly, and Dr Roelof Botha, economic advisor to the Optimum Investment Group, who developed the AFHRI on behalf of Altron Fintech for the Q2 2022 results.

MEDIA RELEASE

Altron FinTech Household Resilience Index (AFHRI) Quarter 2 of 2022 released

Household financial resilience retreats marginally in 2nd quarter; but quarter-on-quarter decline of 0.6% in index value “cause for concern”

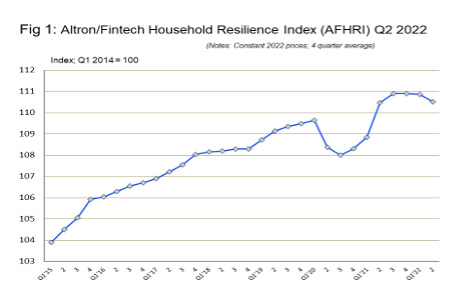

Johannesburg, 6 October 2022 – The results of the latest Altron FinTech Household Resilience Index (AFHRI) were released today. After remaining stable at a new record high for three successive quarters, the AFHRI took a slight dip in the second quarter of 2022, both in terms of its specific quarterly value and the four-year average since it was launched. The latter value has returned to the same level as a year earlier, but still at a higher level than before the pandemic.

In recognition of the need for data that provides more clarity on the financial disposition of households in general, and their ability to cope with debt in particular, Altron FinTech commissioned economist and economic advisor to the Optimum Investment Group, Dr Roelof Botha, to assist in designing this index. The AFHRI comprises 20 different indicators, weighted according to the demand side of the short-term lending industry and calculated on a quarterly basis, with the first quarter of 2014 being the base period, equalling an index value of 100.

Botha says that the latest quarterly reading of 109.2 is marginally lower than the level of 109.9 recorded in the first quarter of 2022 but 1.3% lower than a year ago. “The quarter-on-quarter decline of 0.6% in the index value is a cause for concern, as this is substantially worse than the country’s GDP, which increased by almost 4% in real terms between the first and second quarters of 2022, deflated of course by the consumer price index (CPI).”

He adds that an encouraging feature of the latest AFHRI includes the consistent improvement in the disposable income of households, which is one of only three indicators that has shown growth over all four periods analysed.

The trend in the AFHRI from the first quarter of 2015 to the second quarter of 2022 is shown below. The seasonal peaks and troughs experienced for several of the key individual indicators comprising the index (especially for salaries and household consumption expenditure) are eliminated via a four-quarter average trend.

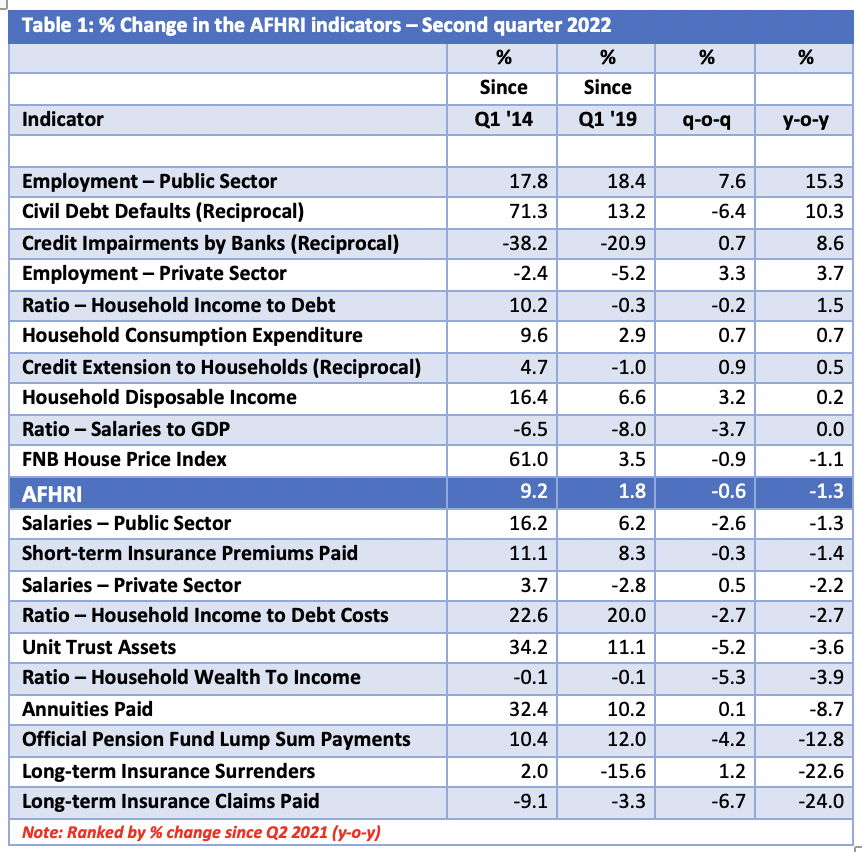

The table below summarises the performance of the different indicators comprising the AFHRI over four different periods, namely since the base period (2014); since the last quarter before the COVID-19 lockdowns kicked in (Q1 2020); and also quarter-on-quarter and year-on-year. The period since the first quarter of 2020 is relevant in order to gauge whether the financial resilience of households has fully recovered from the pandemic.

Botha adds that it should be noted that employment and labour remuneration in the public and private sectors enjoy a relatively high weighting in the AFHRI, as these indicators represent the mainstay of the financial disposition of most households.

“One of the advantages of scrutinising the AFHRI is that it allows comparisons on a time series basis of 20 different indicators that have a bearing on the financial resilience of households, expressed in real terms, i.e., deflated by the CPI. Major variations in individual indicators may serve as guidelines for the likelihood of a future improvement or deterioration of household finances.”

Key conclusions:

- The performance of the index has been lagging behind that of the economy as a whole, especially since 2020. Although the AFHRI has increased by 1.2% since the first quarter of 2020 (pre-COVID-19), the increase in GDP over this period was substantially higher, namely 4.7% (in real terms). One of the reasons for this variance is related to the lagging recovery of private sector employment, which has also impacted negatively on remuneration levels.

- Fortunately, employment in both the private and public sectors increased during the first half of 2022, which should provide a measure of support for the AFHRI during the rest of the year.

- Since the base period for the index, only two of the 20 indicators recorded materially negative outcomes, namely the reciprocal of credit impairments by banks and long-term insurance claims paid, both of which can be attributed to the negative effects of the pandemic.

- On a year-on-year basis, only three of the 20 indicators recorded declines of more than 10%. All three are related to lower levels of lump-sum payments received from long-term insurers and pension funds, which experienced abnormal peaks during the worst of the pandemic and should start following a normalised trend over the next two quarters.

- Although the ratio of household income to debt costs has improved considerably since 2020, negative quarter-on-quarter and year-on-year readings were recorded during the second quarter. With interest rates on the rise, this indicator is bound to weigh on the AFHRI during the rest of the year.

- In recent months, the mood amongst consumers has become decidedly downbeat, due mainly to high fuel prices, rising inflation, higher interest rates and the regular occurrence of electricity load-shedding. Against this backdrop, it is unlikely that the AFHRI will reverse the latest downward trend during the third quarter.

- In the event of inflation and oil prices declining further and the rand exchange rate recovering from a rampant US dollar before the end of the year, the AFHRI could well experience a boost in the fourth quarter, especially when also considering the traditional spike in household consumption expenditure, fuelled by Black Friday sales and Christmas bonuses.

- Due to the strong positive correlation between private sector credit extension and GDP growth, it has become a matter of urgency for government to reconsider the undue regulatory burden that has been placed on the formal micro finance sector. Unless lower income groups are allowed easier access to credit, the pace of employment creation in South Africa will remain muted.

Johan Gellatly, MD of Altron FinTech, says the AFHRI, along with the Altron FinTech Short-term Credit Impact (AFSCI) Index, which was also recently released, provide important guidance not only to players in the credit sector, but also to Altron FinTech itself.

“We need to be aware of trends in the market so that our solutions to clients, which service this sector, remain relevant and effective. What is more, our products and solutions enable our clients to trade in challenging markets efficiently, which is an advantage in times such as these.”

PREVIOUS INDICES

IN THE MEDIA

AFHRI | Dr Roelof Botha | BDTV