Altron Fintech Household Financial Resilience Index (AFHRI)

This index is comprised of 20 different indicators, weighted according to the demand side of the short-term lending industry, and calculated on a quarterly basis, with the first quarter of 2014 as the base period (equalling an index value of 100). With the exception of two indicators (i.e., Household Expenditure and Short-Term Insurance Premiums Paid), the other 18 indicators all have a bearing on income received from various sources or the basis for future income receipts (such as financial or tangible assets). Directly and indirectly, these income sources include salaries, wages, dividends, capital gains, rentals, interest and profits.

The main advantage of composite index methodology is that it allows multi-dimensional issues (often contradicting each other) to be summarised in a single benchmark. It also facilitates the use of reciprocals of individual indicators where these inherently do not support the causality required.

Please join Altron Fintech’s MD, Mr Johan Gellatly, and Dr Roelof Botha, economic advisor to the Optimum Investment Group, who developed the AFHRI on behalf of Altron Fintech for the Q1 2022 results.

MEDIA RELEASE

Altron FinTech Household Resilience Index (AFHRI) Quarter 1 2022 released

Household financial resilience remains stable, but threatened by higher interest rates

Johannesburg, 14 July 2022 – The results of the latest Altron FinTech Household Resilience Index (AFHRI) were released today, showing that the AFHRI is now in stable territory, with one of the key findings being there has been a consistent improvement in the disposable income of South African households, and hence their ability to pay back debt.

“Although the ratio of household income to debt costs has improved considerably since 2019, a negative reading has been recorded since the fourth quarter of last year. With interest rates on the rise, this could weigh on the AFHRI for the rest of the year,” cautions renowned economist, Dr Roelof Botha, who compiles the index on a quarterly basis.

Now in its fourth iteration, the AFHRI is commissioned by Altron FinTech to provide essential data giving more clarity on the financial health of South African households in general, and their ability to cope with debt in particular. Botha says this is important because short-term loans and unsecured credit granted by microfinance institutions play a major role in combating a key element of inequality, namely the ability of South Africans to have money available to spend on consumption goods like food. “The sector also plays a substantial role in financing working capital for SMEs, an important area for South Africa’s growth.”

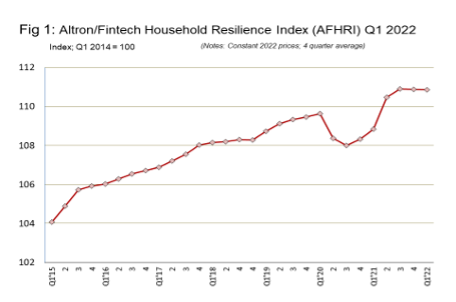

Following the predictable sharp downturn in the AFHRI in the second quarter of 2020 due to the pandemic, most of the key indicators have staged a fairly swift recovery, with the trend line moving back to a positive growth trajectory. “Although the index moved sideways over the past four quarters, it is now 2.4% higher than in the first quarter of 2019, signalling a full recovery from the pandemic.”

The latest index reading of 109.9 is virtually unchanged from the level of 110 recorded in the first quarter of last year, and Botha believes the quarter-on-quarter decline of 2.5% in the value of the index is not a cause for concern. “This is a traditional seasonal trend, and it’s still a relatively better performance for this quarter than the country’s GDP for example, which declined by 3.6% between the fourth quarter of last year and the first quarter of this year.”

He adds that the AFHRI trend line is broadly in line with a number of other recent economic indicators, including the GDP, retail trade sales and the South African Reserve Bank’s leading composite business cycle, which reached an all-time record high in 2021, as did the Absa Purchasing Managers’ Index for the manufacturing sector. Botha says this is due to the relatively high weighting in the AFHRI for employment and labour remuneration. “One of the advantages of the AFHRI is that it allows for comparisons over time, with 16 other indicators that have a bearing on the financial resilience of households. Major variations in the indicators therefore serve as a pointer for the likelihood of a future improvement in or deterioration of household finances.”

Key insights for the first quarter of 2022

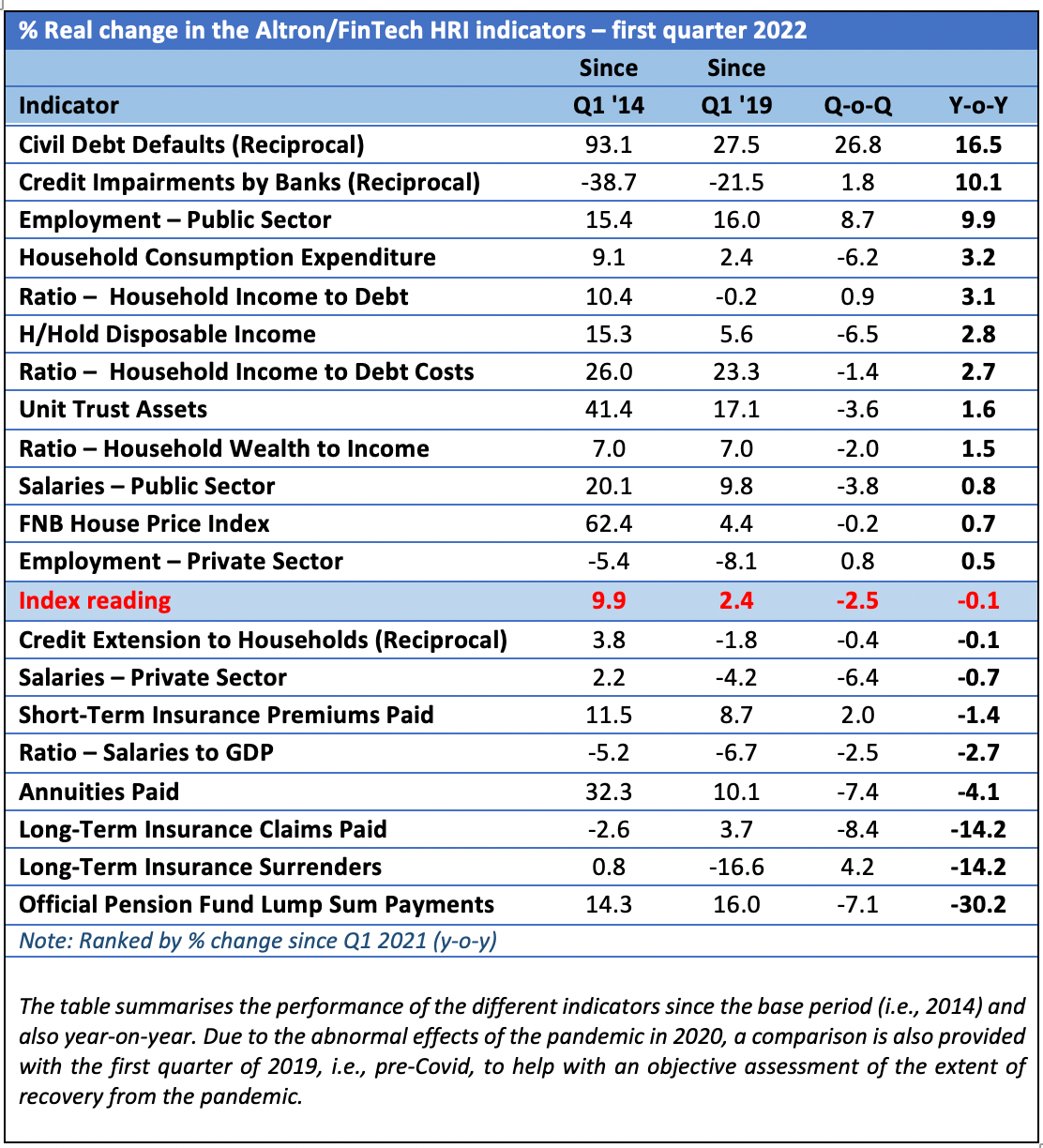

- The performance of the index has lagged behind that of the economy as a whole, especially since 2019. Although the AFHRI has increased by 2.4% since the first quarter of 2019 (pre-Covid), the increase in the GDP over this period has more than doubled at 4.9%. One of the reasons is related to the excellent performance of South Africa’s mining sector, which increased its value added from R66.2 billion in the first quarter of 2019 to R108 billion in the first quarter of this year – an increase of 63% (in nominal terms). Although several companies in the resources sector made huge profits during these three years, a significant share of the resultant dividends flowed to institutional investments. Secondly, formal sector employment remains lower now than in the first quarter of 2019.

- Since the base period for the index, which spans eight years, only four of the 20 indicators recorded negative outcomes, three of which are marginal (from an average annual perspective). The only one that warrants a measure of concern is the level of credit impairments by banks, which remain 21.5% higher than immediately before the pandemic. Although an improvement has occurred over the past year, the return to restrictive monetary policy may thwart further progress.

- On a year-on-year basis, only six of the 20 indicators recorded declines of more than 1%, a clear indication that a measure of stability has returned to the financial disposition of households.

- Fortunately, two of the four indicators that have a large weighting recorded positive growth over the last year as well as since pre-Covid. The best performance was provided by “Public Sector Employment”, with “Public Sector Salaries” also faring well.

- It is a point of concern that employment levels in the more productive private sectors have not yet fully recovered from the pandemic, although marginal growth occurred over the past four quarters.

Given to the strong positive correlation between private sector credit extension and GDP growth, Botha believes that the government needs to urgently reconsider the undue regulatory burden placed on the formal microfinance sector. “Unless lower income groups are allowed easier access to credit, the pace of employment creation in South Africa will remain muted.”

Botha says it is also a point of concern that the Monetary Policy Committee has returned to a hawkish policy stance at a time when various sectors of the economy have not yet fully recovered from the debilitating effects of the pandemic. “Unemployment recently rose to the highest level in South Africa’s modern history and aggregate demand in the economy remains muted. The latter is evident in the fact that capacity utilisation in manufacturing was only 77.8% during the first quarter of the year, 3.7% lower than the level of 80.8% recorded in the first quarter of 2019 (pre-Covid).

“Significantly, insufficient demand was responsible for almost 50% of the unutilised capacity during the first quarter of 2022, a clear sign of an absence of demand-led inflation in South Africa. It is important to note that stricter monetary policy in a country like the US is warranted from two perspectives, the first being that the US has returned to virtually full employment and, secondly, the real mortgage rate remains negative, even after recent rate hikes by the Federal Reserve.”

He believes that South Africa’s monetary policy stance is out of synchronisation with most of its trading partners. “This is vividly illustrated by the fact that few countries have higher real interest rates. In a country where capital formation is desperately required to facilitate higher economic growth and employment creation, it is inconceivable that the cost of capital is so inordinately high.”

Altron FinTech provides a host of solutions to the market, including Debicheck, funeral and credit life insurance collection and payment processing services, debit/credit and access card personalisation and issuance, credit management software, and both standalone and integrated debit and credit card payment solutions, as well as person-to-person card and wallet payments and value-added products for the consumer market

CEO Johan Gellatly explains why the AFHRI is therefore important to Altron FinTech: “Not only do we share this information with our customers, many of whom operate in the SME and microfinance credit provider segment and thus could benefit from an improved understanding of the general health of the finances of South African households, but importantly, we digest the trends and feed key learnings into the design of our products, so they better serve our customers, and so ultimately their customers – the men and women of South Africa.”